Key takeaways

-

Annual rent inflation for new lets is running at its lowest level for 3.5 years

-

Rents have increase by 3% over the last year, down from 7.4% a year ago

-

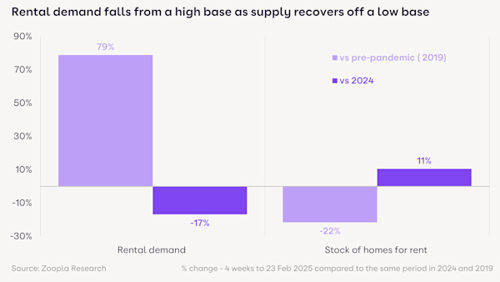

The supply and demand balance is narrowing, with 11% more homes available for rent, while rental demand is now 17% lower than it was a year ago

-

12 renters are currently chasing each home for rent. This is down 42% on 2022-24 levels but still higher than pre-pandemic levels

-

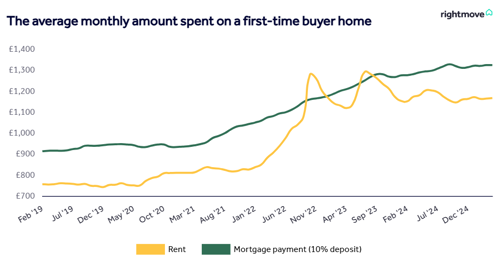

Affordability is a growing constraint on rent rises, with the annual cost of UK rents increasing by £3,000-a-year to £15,400 on average

- The rental market needs more supply, but rental reforms and other proposed policy changes will limit new investment and supply growth

- UK rents are expected to increase by 3-4% over 2025

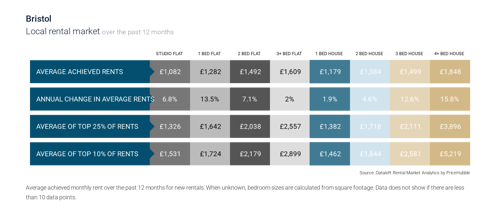

Bristol

Over the last 12 months, the average rent achieved for homes let in Bristol was £1,443 per month. This is a +12% change on the previous 12 month period.

71% of homes let in the past 12 months were flats, achieving an average rental value of £1,389 per month. Houses achieved an average rent of £1,581 per month.

28% of renters are aged between 25 and 29.

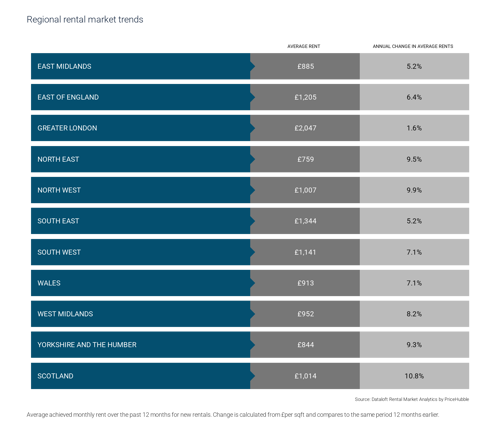

National view point

Rental market conditions are steadily improving after 3 years of chronic undersupply and excess demand. There remains a mismatch in supply and demand, which is not going to rebalance anytime soon, meaning a continued upward pressure on rents.

Rents are increasing at their lowest rate for 3.5 years. However, this has more to do with worsening rental affordability than an improvement in the supply of homes for rent.

Rents have risen 3% in the last year, the slowest rate of growth seen in 3.5 years. (Zoopla)

Demand continues, not least in Bristol.

Property market report

Our up-to-the-minute national, regional and local property market reporting.