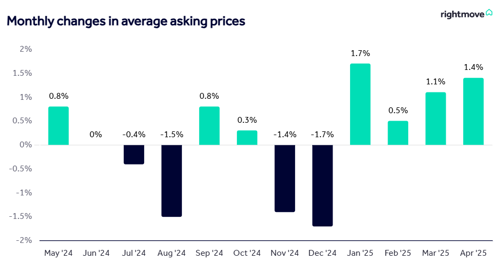

“We’ve seen our first price record in nearly a year, despite the number of homes for sale being at a decade-high. The increased choice seems to be bringing more movers into the market, with both buyer and seller numbers up as the market remains resilient.

Confidence from new sellers is a good sign for the overall health of the market, but they do need to be careful when setting their asking price. The high level of supply in the market right now means that buyers are likely to have plenty of homes in their area to choose from, and an overpriced home will stick out for the wrong reasons. Our research also shows that getting the price right the first time is key. Homes that don’t need a reduction in price are more likely to find a buyer, and to find that buyer in less than half the time.

“It’s important to remember that among records and national trends, Great Britain’s housing market is made up of thousands of diverse local markets, each uniquely responding to market changes and world events. London, for example, is likely to see greater knock-on effects from US tariffs than the rest of Great Britain, while Northern regions appear to be performing more strongly post-stamp duty rise. It’s difficult to predict what the next few months will bring, but if mortgage rates reduce more quickly, it would be a helpful boost to buyer affordability.”

Colleen Babcock, property expert at Rightmove

Additional commentary

The average house price rose to £268,548 in January, a 4.9% year-on-year increase (ONS).

UK house prices are projected to rise by 2.5% in 2025 (Zoopla)

Property market report

Our up-to-the-minute national, regional and local property market reporting.